IRS Issues Affordability Percentage Adjustment for 2019

Just when we thought our day couldn't get any more exciting, the IRS makes an adjustment! Read on to learn more about changes to how determining whether employer-sponsored coverage is "affordable" - in regards to the ACA's employer shared responsibility provisions and premium tax credit program.

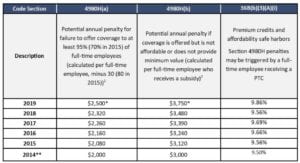

In Rev. Proc. 2018-34, the IRS released the inflation adjusted amounts for 2019 relevant to determining whether employer-sponsored coverage is “affordable” for purposes of the Affordable Care Act’s (“ACA’s”) employer shared responsibility provisions and premium tax credit program. As shown in the table below, for plan years beginning in 2019, the affordability percentage is 9.86% of an employee’s household income or applicable safe harbor.

* Estimated based on premium adjustment percentage in the 2019 Notice of Benefit and Payment Parameters

**No employer shared responsibility penalties were assessed for 2014.

Under the ACA, applicable large employers (ALEs) – generally those with 50 or more full-time equivalent employees on average in the prior calendar year – must offer affordable health insurance to full-time employees to avoid an employer shared responsibility payment. Coverage is “affordable” if the employee’s required contribution for self-only coverage under the employer’s lowest-cost minimum value plan does not exceed 9.5% (as indexed) of the employee’s household income for the year. In lieu of household income, employers may rely on one or more of the following safe harbor alternatives when assessing whether coverage is affordable: W-2, Rate of Pay, and Federal Poverty Level. Each of the three safe harbors refers back to the 9.86% figure in 2019.

The ACA also provides a premium tax credit to assist individuals paying for health coverage in the public marketplace. An individual offered affordable employer-sponsored coverage is generally ineligible for the premium tax credit. Accordingly, for plan years starting in 2019, if a full-time employee’s required contribution for self-only coverage offered by the employer is more than 9.86% of his or her household income (or applicable safe harbor), the coverage will not be considered affordable for that employee and the employer may be liable for an employer shared responsibility payment if the employee obtains a premium tax credit.

Note that beginning January 1, 2019, under the Tax Cuts and Jobs Act, the individual mandate penalty imposed on individual taxpayers for failure to have qualifying health coverage was reduced to $0, effectively repealing the individual mandate. However, despite repeated efforts by the Trump Administration and Congress, the employer mandate has not been repealed and the IRS has begun enforcing the employer mandate by sending Letter 226-J for 2015 informing employers of a potential employer shared responsibility payment. While there continue to be calls to suspend the assessment and repeal the employer mandate, including most recently a letter by industry groups to Treasury and the U.S. Department of Health and Human Services, to date, enforcement has not ceased and the employer mandate remains the law of the land.

Next Steps for Employers:

Applicable large employers should be mindful of the updated affordability percentage for plan years beginning in 2019. Given that the affordability percentage has increased significantly from 9.56% to 9.86%, employers should have additional flexibility when setting “affordable” employee contributions.

The Footnotes:

[1] The “A” penalty applies when an ALE fails to offer coverage to at least 95% of its full-time employees (and their children up to age 26) and at least one full-time employee receives a premium credit for marketplace coverage. The requirement is only to offer coverage – no employer contribution or minimum plan design is necessary to avoid the penalty.

[2] The “B” penalty applies when the ALE offers coverage to 95% of its full-time employees (and their children up to age 26), but the coverage is either not affordable or does not provide minimum value, and at least one full-time employee receives a premium credit.

| About the Author: This alert was prepared for Kuzneski Insurance Group by Marathas Barrow Weatherhead Lent LLP, a national law firm with recognized experts on the Affordable Care Act. Contact Peter Marathas or Stacy Barrow at pmarathas@marbarlaw.com or sbarrow@marbarlaw.com. |

The Legal Stuff: The information provided in this alert is not, is not intended to be, and shall not be construed to be, either the provision of legal advice or an offer to provide legal services, nor does it necessarily reflect the opinions of the agency, our lawyers or our clients. This is not legal advice. No client-lawyer relationship between you and our lawyers is or may be created by your use of this information. Rather, the content is intended as a general overview of the subject matter covered. This agency and Marathas Barrow Weatherhead Lent LLP are not obligated to provide updates on the information presented herein. Those reading this alert are encouraged to seek direct counsel on legal questions. © 2018 Marathas Barrow Weatherhead Lent LLP. All Rights Reserved.

Share Your Thoughts