Why You Should Outsource Your COBRA Administration

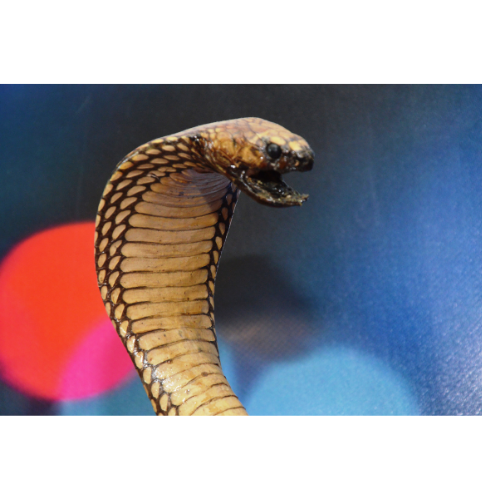

Just like a real cobra, COBRA administration is not something most people want to mess around with. Many companies and benefits administrators find that administering COBRA is cumbersome and complicated. We’re not here to scare you, but the fact is that failure to adhere to COBRA compliance laws can result in very costly fines and liability.

And, just like toying with a real-life cobra, the risks far outweigh the rewards, in the opinion of Stephanie Rosenberger, Director of Client Services at KIG, because there can be a lot to keep track of. There is the timing of various notices that must be sent, specific instructions on how those notices must be filled out, rule changes, reporting requirements ...

COBRA, shorthand for the Consolidated Omnibus Budget Reconciliation Act, requires employers with 20 or more full-time employees, or full-time equivalents, who provide health care benefits to offer continuing health coverage to those who lose their coverage due to termination of employment – whether it’s voluntary or not. The type of qualifying event determines who the qualified recipients are and the period of time that continuation of coverage must be offered. In some states, such as Pennsylvania, “Mini-COBRA” applies to companies with 2 to 19 employees.

Why outsource?

Plan administrators must provide specific notices and disclosures to covered individuals and qualified dependents, and they all have different timeframes and requirements.

“There’s a lot to think about. The Rights to COBRA notice has to be given to each new hire and at renewal time. If not, you’re out of compliance, and you could be fined. What happens when someone expires their COBRA? Do you send a letter, what does that look like, who’s responsible for that?

“Let’s say you mistype something on the COBRA form. Then you have to honor it. It’s in writing,” Stephanie says. “If you’re not COBRA-versed, you’re going to fill it out the way you think you should fill it out. But you don’t know what you don’t know. So, unbeknownst to you, you could be doing something incorrectly, and if there was ever an audit, you could be fined.”

And then there are the myriad different circumstances that may arise.

“Let’s say during the 18 months that someone is on the COBRA plan they get disabled. Are you managing that? Are you going to remember to follow up? Part of it is on the participant, but at the same time, you have to think about all of that stuff,” Stephanie says. “When you’re outsourcing, you take the ‘you’ out of it. You’re not having to think about having to do it, what the rate is, what the timing is, when COBRA expires, what documents you need to file.”

Of course, all of this can be quite time-consuming. Most smaller companies don’t have the budget for an HR person, so the burden of COBRA administration often falls on a CFO, says Stephanie. “It can take a lot of time. Then accounts receivable or the bookkeeper has to collect the COBRA payments and make sure the payments are received and follow up. And then there’s reporting.”

Potential penalties

- IRS excise tax penalty: $100 per day for each qualified beneficiary ($200 per day if more than one family member is affected). The minimum tax levied by the IRS for noncompliance discovered after a notice of examination is $2,500. The maximum tax for “unintentional failures” is 10 percent of the amount paid by the employer during the preceding tax year for group health plans, or $500,000, whichever is less. Believe it or not, the IRS isn’t heartless in this case: If the IRS determines the violation was accidental, employers may be granted a 30-day grace period to fix the issue.

- ERISA penalties: Because ERISA is administered by the Department of Labor, the DOL can levy a fine of up to an additional $110 per day per participant. ERISA can also hold any fiduciary personally liable for non-compliance. An ERISA plan administrator must, upon written request, provide participants and their beneficiaries with copies of documents that they request such as a summary plan document, summary of material modification, annual report, etc.

- Civil penalties: If the threat of penalties from the IRS and DOL aren’t enough to concern you, there is also the potential for civil action. Lawsuits could arise for breach of ERISA fiduciary duty and claims for not offering COBRA coverage under ERISA. Within those lawsuits courts can award damages, as well as interest and attorney fees.

Where can I get help?

Your best bet, Stephanie advises, is to sign an annual agreement with a third-party administrator (TPA) such as PrimePay or WageWorks. Some payroll systems such as Zenefits, Gusto and Rippling include COBRA administration as well. Certain insurance carriers may also offer this service.

Note: Companies with a link above are KIG partners, and we’d be happy to connect you with them.

Another added benefit is that most TPAs have policies to protect clients in the event that a mistake is made.

Not to mention that if you let a TPA handles COBRA for you, employers can avoid potentially awkward or emotional issues that can arise with former employees.

But what if your company doesn’t have a lot of turnover?

“That’s an even bigger reason not to do it yourself,” Stephanie says. “You may be out of practice, you might miss something, you might not be keeping up with the current laws. For example, COVID changed a lot of things, at least temporarily. Laws change every day. How do you keep up with it, and why would you want to? A third-party administrator takes care of that. They do it all.”

Cost

These services generally cost $50-$60 per month for companies with fewer than 50 employees, Stephanie says. Some vendors only charge based on the number of COBRA participants. “To me it’s a no-brainer. It’s just the cost of doing business,” she says. Not to mention peace of mind!

In case you’re brave enough to handle COBRA administration on your own, Stephanie offers this pro tip: “I always advise clients: ‘I don’t care why an employee left, give them a COBRA notice, even if they tell you they don’t need COBRA.”

Here is a useful, albeit long, resource on COBRA from the U.S. Department of Labor.

Share Your Thoughts