7 of the Biggest Misconceptions in Health Insurance

Like it or not, having health insurance is part of adulting, but it’s not a topic of conversation you’re likely to have in the digital lobby. (You know, the few minutes of banter – or awkward silence -- while you’re waiting for a virtual meeting to start? Call it the new proverbial water cooler.) Sure is cold out there. That was a great game last night! Wait, Grey’s Anatomy is still on TV?! Stayed up way too late reading my Summary of Benefits and Coverage last night … I just HAD to see how it ended!

Understanding your health insurance plan can help you use it more wisely – and potentially save you money. Here are some of the biggest misconceptions people have about health insurance, brought to you by KIG’s Client Services Team. They know because, well, they hear them all the time. Read this as a starting point with a host of other content available to help you explore each of these concepts.

1. Health insurance is too expensive

One of the biggest misconceptions is centered around how health care is designed and what it costs.

“Some people think, ‘I have insurance, and that’s all I need to know,’” says Stephanie Rosenberger, Director of Client Services at KIG. “But there’s a lot that goes into it.”

There are two connotations to this, Stephanie says: plan design and premium. To appropriately evaluate a medical insurance plan, you have to examine it in its entirety, she says. Some people think that if a plan has a high deductible, it is expensive, without considering features of the rest of the plan.

There are two connotations to this, Stephanie says: plan design and premium. To appropriately evaluate a medical insurance plan, you have to examine it in its entirety, she says. Some people think that if a plan has a high deductible, it is expensive, without considering features of the rest of the plan.

“If co-pays are low and there’s no co-insurance, to me, that is a richer design than a plan that has most services go toward a deductible and then has co-insurance afterward,” she says. “For instance, a Health Savings Account has all costs going toward the deductible. In many cases once the deductible has been met, the plan pays in full. If it does not pay in full, it usually has a lower out-of-pocket maximum.

“Some employees think that buying a deductible plan is better because most of the cost is through copays. But you can be copay-ed to death. For instance, you have a surgery with a $1,500 deductible and then follow-up physical therapy for $50 per visit. You may have 10 visits, so now for that one surgery you paid $2,000, plus any other associated costs like an urgent care visit or medications.

How you utilize a medical plan also factors into your out-of-pocket cost, and this can boil down to being a smart consumer of health care.

Say you have a nose bleed and you go to the ER. That might cost you $500, but you probably could have gone to urgent care and paid your $50 co-pay, which saves you $450, Stephanie points out. “So, are you using your plan appropriately?”

Related: ER or Urgent Care: Where Should You Go?

Get familiar with any “value adds” that your insurance plan offers – services that go beyond the basic provisions of the plan. These can include things like medical travel assistance or employee assistance programs. Many insurance carriers have a portal for their customers with a host of (often free) resources, including ways to manage stress, a budget calculator, health care coaching, workout videos, maternity services, smoking cessation and weight management classes, information on diabetes control, and even discounts on health care products at various locations.

Melissa Craig, Benefits Advocate at KIG, points out that, in her experience, many employees aren’t aware that they have access to these additional resources. This is particularly true in companies that are too small to be able to afford an HR professional. But you don’t need to be part of a large company to understand value-add services.

“When most people think of a group medical plan, they’re just thinking, ‘what’s my deductible, how much does it cost to go to a doctor, or how much does my drug cost?’ It’s just some things that we face from an education standpoint. People just don’t know about those services,” Melissa says.

An insurance carrier’s eligibility standards, rates and even plan options often differ by state, and even by region within a state. For example, UPMC customers in a rural area may only have access to one plan option, while those in a more populated urban area are more likely to have access to all the plans that UPMC provides.

“Each carrier (such as UPMC, Highmark, Aetna, Cigna, United Healthcare, etc.) has their own rules and ways of doing things and what they’re willing to do and not do,” Stephanie says.

In other words, there’s often more than meets the eye when comparing the cost and services of medical insurance plans, but there are things consumers can do to keep costs down, too.

2. How to read EOBs and SBCs

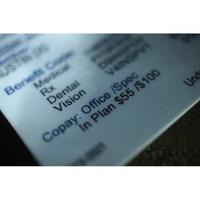

Many people don’t know that health insurers are federally mandated to provide a Summary of Benefits and Coverage (SBC), which can be key to understanding details of your plan. You should read it carefully to understand what is and what is not covered.

“An SBC is really confusing. It may say that a surgery is no charge, but unless you read a very small line at the top that says ‘after deductible,’ the misconception for someone who has not been taught how to read an SBC is that they assume there’s no charge for that surgery,” says Stephanie.

It’s always best to read the SBC and the Explanation of Benefits (EOB) for a complete picture of your coverage, advises Vickie Davidson, Client Advisor. An EOB is a statement from an insurance carrier detailing what costs it will cover for medical care or products, and what the patient owes. You’ll get an EOB after you receive medical care but before the actual bill.

Billing for maternity is an area that can be confusing because some carriers may bill for the whole pregnancy, and others may bill per visit. Wonder if you’ll be doubly charged now that there are two lives? (You won’t.) Is your grandchild covered under your insurance plan as soon as your daughter gets pregnant? (Yes.)

The bottom line is that understanding these documents is key to helping you better anticipate medical expenses.

Go more in depth:

3. HSAs, FSAs and HRAs … oh my!

Aside from medical plans themselves, the differences among supplemental options such as a Flexible Spending Account (FSA), a Health Reimbursement Account (HRA) and a Health Spending Account (HSA) can be confounding.

“The HSA often gets confused with the HRA and the FSA,” Vickie warns. “What can you and can you not have with all of these plans and added benefits?”

What often makes them attractive is that all three have tax advantages, for both employers and employees. Here are some highlights of each:

HSA

- You — not your employer or insurance company — own and control the money in your HSA.

- If you leave your job, your HSA account goes with you.

- Must be used in combination with a qualified High Deductible Health Plan (HDHP).

The IRS dictates annual contribution limits, and contributions can be changed as often as your employer allows.

Read more: What is an HSA?

FSA

- Unused funds are lost at the end of the year, unless an employer permits a carryover.

- You cannot take an FSA with you if you leave your job.

- You can only enroll at specific times.

- The IRS dictates annual contribution limits.

- An FSA can be used to reimburse expenses related to childcare and commuting and parking.

For a deeper dive: How Does an FSA Differ From an HSA?

HRA

- Employers fund an HRA, set the contribution limit and decide what it can pay for.

- Employers also decide whether unused funds carry over to the next year.

- Employees may not take an HRA with them if they leave a job.

For a deeper dive: How Does an HRA Work?

4. Medicare requirements

This one’s a doozy. Even Vickie, KIG’s resident Medicare expert, admits, “Medicare is a creature all its own.”

A lot of confusion centers around people who are employed beyond the Medicare eligibility age of 65. .png?width=230&name=Medicare%20(1).png)

“People think, ‘if I’m still working, and I turn 65, I have to have Part A and B or I’m going to get penalized.’ That is not always true,” Vickie says. “It depends on your situation, and it depends on group size. It depends on a lot of things.”

Another common misconception is that an employer can force an employee to leave a group health plan and go on Medicare once they hit 65.

“If you’re a full-time employee, you have the same rights as anyone else,” Vickie stresses. “An employer can suggest that an employee goes on Medicare because it may be cheaper for the employee and for the company, but they cannot force you to.”

For those who are new to the concept of Medicare, how it all fits together is even confusing. There are essentially five parts:

- Part A is hospital insurance and helps cover inpatient care in hospitals, skilled nursing facility care, hospice care and home health care.

- Part B is medical insurance and helps cover services from doctors and other health care providers, outpatient care, home health care, durable medical equipment (wheelchairs, walkers, hospital beds) and preventive services (screenings, shots or vaccines, and wellness visits).

- Part D is a prescription drug plan, which, naturally, helps cover the cost of prescription drugs. An important thing to know here, Vickie says, is that if you do not enroll in Part D coverage when you turn 65 (and are retired), it’s kind of like playing Russian Roulette. Why? Because, if you decide later to enroll, you will be penalized for each month that you did not have coverage after becoming Medicare-eligible.

- Part C is known as Medicare Advantage, a Medicare-approved plan from a private company that offers an alternative to Original Medicare for health and drug coverage. These “bundled” plans include Parts A and B, and usually Part D. These plans may also offer dental and vision coverage.

And then there’s Medigap (often called a Medicare Supplement Insurance). In short, Medigap helps fill “gaps” in Medicare and is sold by private companies. Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medigap policy can help pay some of the remaining health care costs, such as copays, coinsurance and deductibles. These plans are named by letter, like Plan G or Plan K.

Our Medicare 101 Blog explains Medicare in much more detail.

Here is another good resource for all things Medicare.

5. My insurance will be accepted

Sometimes it’s not insurance in general but medical providers that can trip you up.

“People think, ’I’m going to the doctor, and they’re the experts.’ Sure, they may be, medically speaking, but when it comes to insurance, that’s not their job,” Stephanie says. “So you can never assume when you go to a provider that everything’s going to be covered by insurance. When you call and ask if a provider takes your insurance, every doctor will say yes, but that does not mean they are in network.”

Vickie suggests asking these specific questions:

“Are you a participating provider of my insurance?”

“Will my bill be paid in full because you are appointed with the carrier?”

“Do you accept the insurance carrier and the plan?”

To be 100% certain that a medical provider will accept your insurance plan, check with the insurance carrier directly, or with us if you’re a KIG customer. The carrier’s phone number is typically on the back of your health insurance card, usually listed as “member services.”

Less of a misconception and more of a knowledge gap, Stephanie says, has to do with medical claims themselves.

“People assume that if they have insurance, their claim will be paid. They don’t understand there’s more to it,” she says. “It depends. Was the procedure clinically appropriate? Was it correct for the diagnosis? Is the diagnosis even covered?”

These are all questions you should ask a medical provider or the insurance carrier before agreeing to any procedure. The answers can save you from having to pay out of pocket for something the carrier considers elective, or not necessary.

That being said, “all plans will cover a true medical emergency regardless of whether you have in- or out-of-network benefits,” Stephanie says – whether you have a serious skiing accident while visiting Colorado or suffer a heart attack when you find out your wife is expecting twins.

6. Generic drugs are cheaper

Once upon a time, this was generally true, but a lot has changed over the years, and now prescription drug prices are based more on formularies, Stephanie says. It’s not enough to know whether a prescription is a generic (denoted with all lowercase letters) or a brand name (printed in ALL CAPS.) It’s important to know what drug tier it falls in. To do this, you must refer to an insurer’s prescription drug list (PDL). Medications are grouped into tiers, and your copay for that drug is based on which tier the drug falls under. Most SBCs list up to five tiers.

Once upon a time, this was generally true, but a lot has changed over the years, and now prescription drug prices are based more on formularies, Stephanie says. It’s not enough to know whether a prescription is a generic (denoted with all lowercase letters) or a brand name (printed in ALL CAPS.) It’s important to know what drug tier it falls in. To do this, you must refer to an insurer’s prescription drug list (PDL). Medications are grouped into tiers, and your copay for that drug is based on which tier the drug falls under. Most SBCs list up to five tiers.

“You can have a high-cost generic medication,” Stephanie says, “so it’s really important that when people are looking at their medications that they understand what tier their medications fall into. Just because it’s a lowercase drug doesn’t mean it’s going to be cheaper.”

Read more: How Do I Read a Prescription Drug List?

7. Changing plans will be smooth sailing

Switching from one insurance plan to another – or even renewing the same coverage – can cause a gap in coverage. Your best bet is to get prescriptions filled before the old insurance plan expires so it is billed under the old cost structure or formulary, Melissa says. Likewise, give yourself a couple of weeks after the renewal before scheduling an appointment, if at all possible.

“Trying to get your doctor visits in and getting your prescriptions filled before your new plan goes into effect are best practices that we follow at KIG, and we also advise our clients and their employees to do the same. Employees assume that everything is going to be set up and ready,” she says. “But the client may not be in the system yet when the new plan starts.” Even if there are no changes to the plan (known as “renewing as is”), mistakes can still happen.

If you’re in the middle of ongoing treatment, such as chemotherapy, rest assured you will be covered. And if you have a necessary doctor’s appointment scheduled around the time your old plan expires, “you’ll still have coverage, but you may have to refile the claim or pay for it up front and get reimbursed,” Vickie advises. “The coverage will always be retroactive. It just may take a week or so to get everything moved over. If you can avoid all of this, you’re better off.”

Still, Melissa says, don’t feel like you have to cancel an important appointment: “Some people don’t realize we can help them get reimbursed instead of canceling the appointment.”

Additional resources:

What Should I Do When My Employer Changes Medical Plans?

What Information Do I Need for a Claims Issue?

We know, adulting is hard! But understanding these concepts will help you make better use of your health insurance plan – and potentially save you money in the process. If you would like to discuss any of these issues further, give us a call!

Share Your Thoughts